The SENDAUDIT suite aims to support all stages of the tax control cycle from the perspective of information analysis:

This holistic approach generates a series of POSITIVE EXTERNALITIES for the client organization:

- Retention of knowledge through the use of repositories for test plans, selection plans composed of expert rules, or schemes for importing third-party information.

- Greater confidence in the information supporting the analyses, thanks to exhaustive data quality control through integrity checks and validations during the normalization process.

- Increased analytical capabilities available, reinforcing the deterrent effect generated among taxpayers and promoting voluntary compliance.

- Improved communication between work teams due to the use of a common analytical language based on standardization.

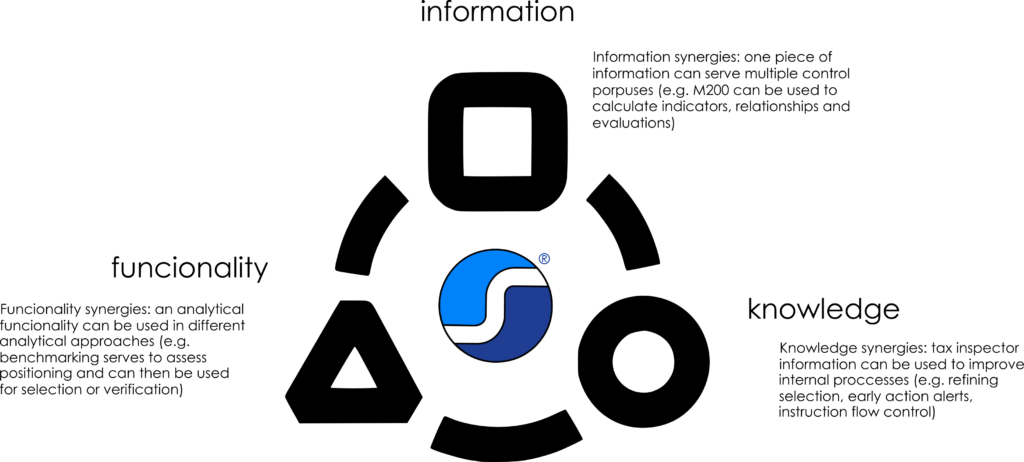

Additionally, the integration of the solutions within the SENDAUDIT© suite generates SYNERGIES IN INFORMATION, FUNCTIONALITY, AND KNOWLEDGE within verification procedures:

As a result, there is an increase in efficiency in verification tasks, as well as in the levels of fraud detection and accreditation, leading to higher productivity for the organization.

For more information on how your organization can enhance its analytical capabilities using SENDAUDIT, please contact us.

No Comments

Sorry, the comment form is closed at this time.